Mayor’s message: LIPA Tax Settlement and What’s On The Horizon

February 1, 2019

Life within the 11777 ZIP Code is about to get real. For decades we were subsidized by the Long Island power Authority’s overassessed power plant. Assessed at over $1billion dollars, the plant represented upwards of 1/2 of the assessment roll which in layman‘s terms means that half our tax revenue each year came from the power plant property. If a price tag were put on the old iron plant today experts argue it’s value could be as low as $300 million. Anyone can easily figure out that means the plant is greatly over assessed.

Fighting this widely publicized tax grievance case for over 8 years, it shocks me how many people still are unaware of the fact that the Village of Port Jefferson and the Town of Brookhaven finalized a settlement in late 2018. The terms of settlement shelter us from having to pay back taxes (taxes collected during the 6 year long court battle) while also providing a glide path moving forward over the next 8 years during which the 50% reduction of tax revenue can be absorbed. Currently the school district and Village are working on budgets in year 2 of the glide path, preparing to offset a loss upwards of 7-8 % of the annual revenue.

The Port Jefferson community is strong with life-long residents who take pride in preserving and strengthening our legacies and the traditions which make Port Jefferson a truly unique place to live and work. We have done a fine job building programs while preserving our legacies and cultural traditions. Each agency has worked within our individual silos, head to desk, sleeves rolled up, concentrating on the ins and outs of the daily operations to make sure our streets were plowed and paved, our schools blue ribbon, our fire department ready to respond, the EMS equipped to save lives and our library able to provide services to both young and old.

I have full faith we will continue to grow and excel as the premier Village of the North Shore despite the adjustments we will all have to make. In the early years of our glide path, now is the time to come together to do proper assessments, identify resources and assets, and avoid duplication of services to ensure that all needs are being met before any cuts are made to programs and staffing. Yes, we are prepared to pay more – but how much more and where’s the ceiling? Since we are all striving to pull from the same wallet, let’s make sure we are not pitting one program against another and that we are utilizing our existing assets, parks, gyms, community centers, libraries and community spaces as efficiently and as effectively as possible before we make new expenditures or build new walls.

Lets come out of our silos to work together, to plan and build. To offset and preserve. To create and save. We have the opportunity to strive to be better, to come together as the home team. We owe this to each other, to our children and our grandparents. Where there is a will – there is a way. I believe Port Jefferson will always be the preferred place to live and create a family because we have the opportunity now to shape our own destiny, enriching tomorrow by saving today and working together, united in Royal pride.

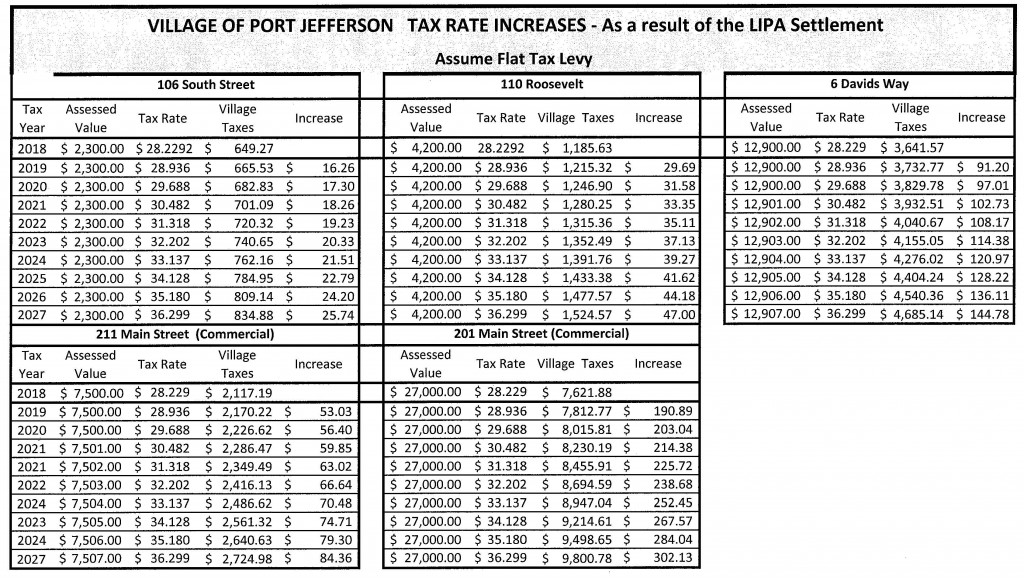

This schedule shows the tax impacts based on three different residential properties – a small older, historic home, a mid size colonial home built in the 70’s or 80″s and a newer larger home up in Harbor Hills area. The commercial properties we selected were a smaller historic mixed use building down port and a much larger – multi unit retail and residential mixed apartment. It assumes everything else is fixed – no increases. Just the LIPA increase in isolation.